7 Best Fraud Prevention Software in 2024

Don’t you hate when you’re hit with a fraudulent transaction, potentially losing revenue and your customers’ trust?

Did you know that in 2021, businesses lost a whopping $56 billion to online fraud?

Ouch, right? To help protect your hard-earned profits and keep those scammers at bay, we’ve compiled a list of the best fraud prevention software on the market. Let’s dive in and fortify your business!

Top Fraud Prevention Tools

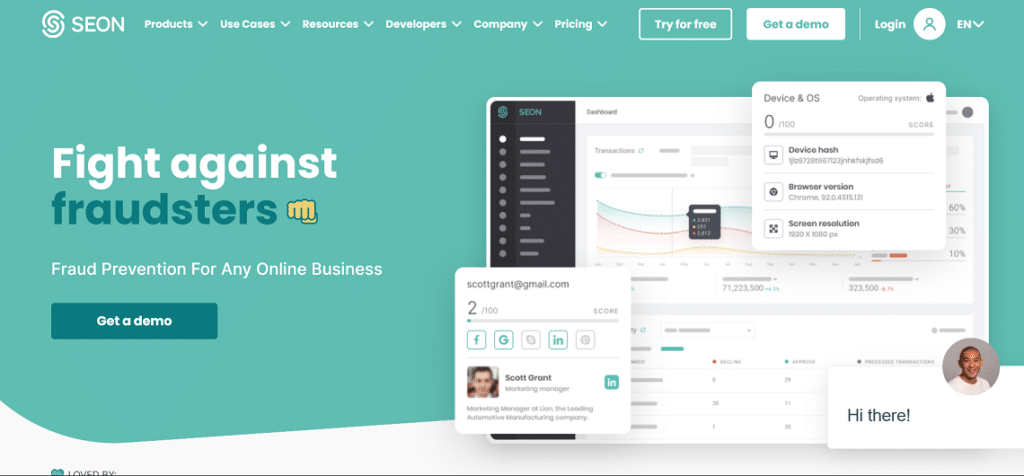

1.

SEON is a powerful fraud prevention software that uses machine learning and advanced analytics to help businesses protect against fraudulent activities. Key benefits include:

- Real-time detection: Quickly identify and prevent fraudulent actions in real time with machine learning algorithms.

- Comprehensive data analysis: Leverage extensive data points, device fingerprinting, and IP analysis to assess risk.

- Customizable rules engine: Tailor fraud detection rules to your business needs and risk tolerance.

- Adaptive response: Continuously learn and adapt to new fraud patterns, improving detection accuracy.

- Seamless integration: Easily integrate SEON into your existing systems with flexible API options and pre-built modules.

Pricing: Paid

Pricing page: https://seon.io/pricing/

2.

ClearSale is a leading fraud prevention software that protects businesses against fraudulent transactions and chargebacks. Key benefits include:

- High accuracy: Utilize a combination of advanced technology and experienced analysts to deliver accurate fraud detection.

- Chargeback prevention: Minimize chargebacks and protect revenue with proactive management strategies.

- Customizable rules: Tailor fraud detection rules to match your business’s unique requirements and risk appetite.

- Seamless integration: Integrate ClearSale with popular eCommerce platforms, payment gateways, and custom applications.

- 24/7 support: Rely on dedicated customer support and a global team of fraud analysts to safeguard your business around the clock.

Pricing: Paid

Pricing page: https://www2.clear.sale/fraud-protection/pricing

3.

Signifyd is an innovative fraud prevention software that uses artificial intelligence and machine learning to secure online transactions and reduce chargebacks. Key benefits include:

- AI-driven detection: Leverage advanced algorithms and machine learning to identify and block fraud in real time.

- Guaranteed chargeback coverage: Receive full reimbursement for any chargebacks, providing peace of mind and financial security.

- Automated order review: Automate decision-making and order review processes to minimize false declines and streamline operations.

- Customizable solution: Configure fraud prevention settings to match your business requirements and risk tolerance.

- Easy integration: Effortlessly integrate Signifyd with major eCommerce platforms and payment gateways for seamless fraud protection.

4.

Riskified is a cutting-edge fraud prevention software that uses machine learning to protect online transactions while boosting revenue. Key benefits include:

Machine learning technology: Sophisticated algorithms detect and prevent fraudulent activities in real time.

Chargeback guarantee: Receive total compensation for any approved orders that result in chargebacks, ensuring financial security.

Higher approval rates: Maximize revenue by minimizing false declines and increasing legitimate order approvals.

Dynamic friction: Apply an adaptable level of authentication to provide a smooth customer experience without compromising security.

Seamless integration: Easily integrate Riskified with popular eCommerce platforms and payment gateways for comprehensive fraud protection.

5.

Sift is a powerful fraud prevention software that harnesses the power of machine learning to secure online transactions and build digital trust. Key benefits include:

- Real-time detection: Leverage advanced machine learning models to identify and prevent real-time fraud.

- Adaptive learning: Continuously adapt to evolving fraud patterns for improved detection accuracy and reduced false positives.

- Customizable solution: Tailor fraud detection and prevention strategies to your unique business requirements and risk tolerance.

- Data-driven insights: Make informed decisions with comprehensive fraud analytics and reporting tools.

- Multi-layered protection: Secure various aspects of your business, including payment, account, and content integrity, with a single, unified solution.

6.

Kount is a leading fraud prevention software that offers businesses robust protection against fraudulent transactions with its AI-driven Identity Trust Platform. Key benefits include:

- Advanced AI technology: Utilize machine learning and customizable rules to accurately detect and prevent fraud in real time.

- Identity Trust Platform: Assess the trustworthiness of users’ digital identities to make informed decisions and minimize false declines.

- Customizable solution: Configure fraud prevention settings to suit your business requirements and risk appetite.

- Multi-layered protection: Safeguard your business from fraud types, such as payment, account takeover, and new account fraud.

- Seamless integration: Integrate Kount with popular eCommerce platforms, payment gateways, and custom applications for comprehensive fraud management.

Pricing: Paid

Pricing page: https://go.kount.com/pricing

7.

CyberSource is a comprehensive fraud prevention and payment processing software that offers businesses powerful tools to secure online transactions. Key benefits include:

- Advanced fraud detection: Utilize machine learning, rules-based systems, and data analytics to identify and prevent real-time fraudulent transactions.

- Secure payment processing: Safely process payments with built-in tokenization and PCI DSS-compliant security features.

- Global support: Access various payment options, currencies, and languages to cater to an international audience.

- Customizable solution: Tailor your fraud prevention and payment processing strategies to suit your unique business requirements and risk tolerance.

- Easy integration: Seamlessly integrate CyberSource with popular eCommerce platforms, payment gateways, and custom applications for holistic fraud protection.

Further reading

What Is E-Commerce Fraud Prevention Software?

Fraud detection and prevention solutions are technologies that enable businesses to successfully monitor and prevent high-risk, phony, or fraudulent online transactions. E-commerce fraud protection software facilitates online businesses to automatically approve or reject payments to reduce the risk of chargebacks.

Refuting chargebacks, friendly fraud, or return fraud are all made easier with the ability to record user and transaction information. The same software may also safeguard user accounts from being compromised by enhancing authentication security.

These solutions can monitor various indicators, including financial transactions, user devices, acts, orders, etc.

What Are the Most Common Types of E-Commerce Fraud?

Fraudsters attack e-commerce by stealing credit card information, leading to a high rate of chargebacks.

Account takeover, often known as ATO, is another method hackers use to access a victim’s account.

You should also look for multi-account fraud, creating multiple profiles to reap benefits if you reward referrals.

Basics of E-Commerce Fraud Prevention

1. Make use of AVS (Address Verification System)

AVS helps secure your online business by validating whether or not the customer’s billing address matches the information on file with the credit card provider.

2. Follow PCI (Payment Card Industry) standards

PCI includes security guidelines that all online businesses must follow. These guidelines increase the security of your transactions. Even if your e-commerce payment processing channels are secure, you risk falling prey to e-commerce fraud or even being sued if you do not follow PCI requirements.

3. Require strong password

Although we commonly become annoyed by too-tight password policies, a complex password will protect your clients and business. Your password should contain various characters, making accessing it more difficult for hackers.

Wrap Up

We’ve taken you through the top fraud prevention software options that can help safeguard your business from those pesky fraudsters.

The right software is crucial for maintaining your revenue and customer trust.

So, explore these fantastic options to protect your business and give yourself the peace of mind you deserve.

Stay safe, and keep thriving!

FAQs

Fraud prevention software is a tool or platform designed to help businesses and organizations detect, prevent, and manage fraudulent activities. These tools use advanced technologies, such as artificial intelligence (AI), machine learning, and data analytics, to identify and flag suspicious transactions, behaviors, or patterns that may indicate fraud, helping businesses reduce financial losses and protect their reputation.

Businesses need fraud prevention software to protect themselves from various types of fraud, such as credit card fraud, identity theft, and account takeover. Fraudulent activities can result in significant financial losses, damaged customer relationships, and a tarnished reputation. Fraud prevention software helps businesses detect and prevent fraud in real time, reducing the risk of financial loss and maintaining customer trust.

Critical features of fraud prevention software include:

• Real-time monitoring: Monitors transactions, user behaviors, and patterns in real-time to detect potential fraud as it occurs.

• Advanced analytics: Uses AI, machine learning, and data analytics to identify and flag suspicious activities and patterns.

• Risk scoring: Assign risk scores to transactions or users based on their likelihood of fraud, helping businesses prioritize investigations.

• Customizable rules and thresholds: Users can create and customize them based on risk tolerance and business requirements.

• Reporting and visualization: Generates reports and visualizations to help users understand fraud trends, patterns, and the effectiveness of their fraud prevention measures.

• Integration capabilities: Seamlessly integrates with other tools and systems, such as payment gateways, eCommerce platforms, and CRM systems.

The best fraud prevention software options include Kount, Sift, Riskified, Signifyd, and RSA Fraud & Risk Intelligence Suite. These tools cater to different user needs, budgets, and levels of expertise, offering a range of features and capabilities.

To choose the right fraud prevention software for your business, consider factors such as your budget, the size of your organization, the types of fraud risks you face, and the specific features you require. Look for tools that offer the features most relevant to your needs, and use free trials or demos to evaluate each tool’s suitability.

Yes, fraud prevention software suits businesses of all sizes, from small startups to large enterprises. Many fraud prevention tools offer scalable features and pricing plans that cater to different business sizes, ensuring that organizations can find a solution that meets their needs and budget.

Reputable fraud prevention software tools prioritize data privacy and security by implementing various measures, such as data encryption, secure data storage, access controls, and compliance with relevant data protection regulations (e.g., GDPR). Before choosing a fraud prevention software, review its privacy policy and security features to protect your data and customers’ information.

Yes, fraud prevention software can reduce the risk of financial losses by detecting and preventing fraudulent activities in real time. By identifying and flagging suspicious transactions, behaviors, or patterns, these tools help businesses minimize the impact of fraud, protect their reputation, and maintain customer trust.